Tax Benefits for Donors

Introduction

Donations made to Give2Asia and our affiliates may qualify as a charitable contribution for tax purposes. However, this only applies in specific jurisdictions. Gift acknowledgments and tax receipts (“acknowledgements”) can only be issued from the charitable entity to which you make your donation. Please ensure that you are giving to a fund held by the Give2Asia entity in the location where you seek tax benefits. Donations cannot be refunded once an acknowledgment has been issued.

Give2Asia’s charitable entities

To support our donors and charitable projects and programs, Give2Asia’s network includes affiliated charitable entities in three different jurisdictions:

- Give2Asia (EIN 94-3373670) is a U.S.-based 501(c)(3) public charity.

- Myriad Australia Ltd (previously Give2Asia Australia Ltd) ABN 20 640 318 636 is endorsed by the Australian Taxation Office as a Deductible Gift Recipient (DGR).

- Give2Asia Foundation Ltd in Hong Kong SAR PRC is a tax exempt organization under Section 88 of the Inland Revenue Ordinance (Hong Kong IR File Number 91/11865).

Through the Myriad alliance, Give2Asia also can assist donors and support charitable projects and programs in Canada and Europe. Contact us for details.

How to Identify Where a Fund is Held

Each fund in Give2Asia’s network is established, supported and held by a specific Give2Asia charitable affiliate (each, a “Fund”). Here is how you can determine which entity holds a Fund, for the purposes of determining whether your donation might be eligible for tax benefits:

Credit Card Donations

For online donations on Give2Asia.org, the entity holding the Fund is indicated on each donation form in two ways:

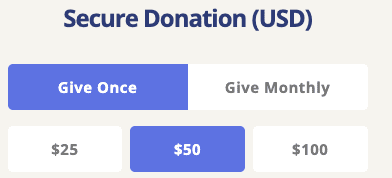

1) Donation form currency

For example:

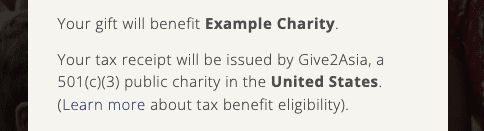

2) Donation form tax receipt notice

For example:

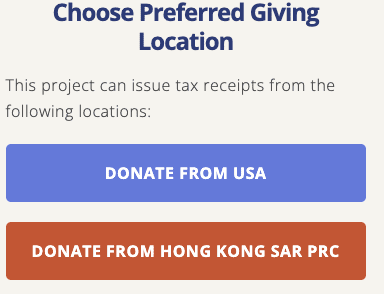

If a Fund is supported by more than one Give2Asia affiliate, donors can click a “Donate from another location” link to switch to an affiliate in another tax jurisdiction:

Once a Fund at a Give2Asia affiliate is selected and the donation completed, an acknowledgement will be issued from that entity (and may not be issued from any other entity for tax purposes).

Other Donation Methods

Donations made by wire transfer, paper check/cheque, or other methods must also be sent to the appropriate Give2Asia entity. Before donating, first-time donors should confirm that:

- You are using the transfer information for the correct charitable entity (e.g. bank account and routing number), and

- A fund exists at that charitable entity for your intended charity or project.

Donors must also complete a gift form for non-credit card donations. This informs Give2Asia which fund should receive your gift.

If you have any questions, please contact us before sending your gift.

Other Potential Tax Benefits for US Donors

The following information is provided for educational purposes only. Give2Asia does not provide tax or legal advice. Please consult a qualified tax or legal professional regarding your individual situation.

Donors who plan to make a large gift may also wish to explore a donor-advised fund at Give2Asia. This may offer additional tax planning advantages, such as:

Capital gains tax benefits: By donating appreciated securities or assets to Give2Asia—instead of selling them to donate the proceeds—donors may avoid paying capital gains tax while still benefiting from the full value as a tax deduction.

Current-year deduction and tax-free growth: For our Donor-Advised Funds, donors may receive an income tax deduction for the full market value of your donation in the year the contribution is made, regardless of when you recommend grant distributions. This could make a Give2Asia fund a great solution in a year when you could most benefit from a large deduction but are not ready to decide where you want to make grants. Funds contributed to an Advised Fund are invested and grow free of tax on investment income, potentially providing even more funds for grantmaking.

Estate planning benefits: Give2Asia funds also can be a useful tool for your estate planning. For example, you may make a fund at Give2Asia the beneficiary of a charitable remainder trust, life insurance policy or qualified IRA assets, or make a testamentary gift to a fund in your will. Your fund can continue to be advised by family members or others you appoint.

To learn more about donor-advised giving at Give2Asia, contact our international giving team.